The simple idea of Don’t Cook, Just Eat! Has made the company worth nearly 1.5billion.

Just Eat is an online service where customers can order from their local takeaways. It’s become so popular, shares of the takeaway website went up 5 percent on its debut day of trading on the London Stock Exchange. It is the biggest technology float on the London market for eight years.

The company was founded in Denmark in 2001 and they decided to make ordering takeaway that little bit easier. Just Eat UK was launched in 2006 and offers over 30,000 restaurants for the hungry public to choose from. Its website and mobile apps handled more than 40m takeaway orders last year. Just Eat charges restaurants nearly 11% commission on each order placed, worth an average of £2.11 per order last year. Just Eat priced its shares at 260p, the top end of its range, valuing the business at more than 100 times last year’s £14.1 million underlying profits — but investors devoured more: Just Eat was the most traded stock on the Footsie, as its shares rose 14.6p to 274.6p.

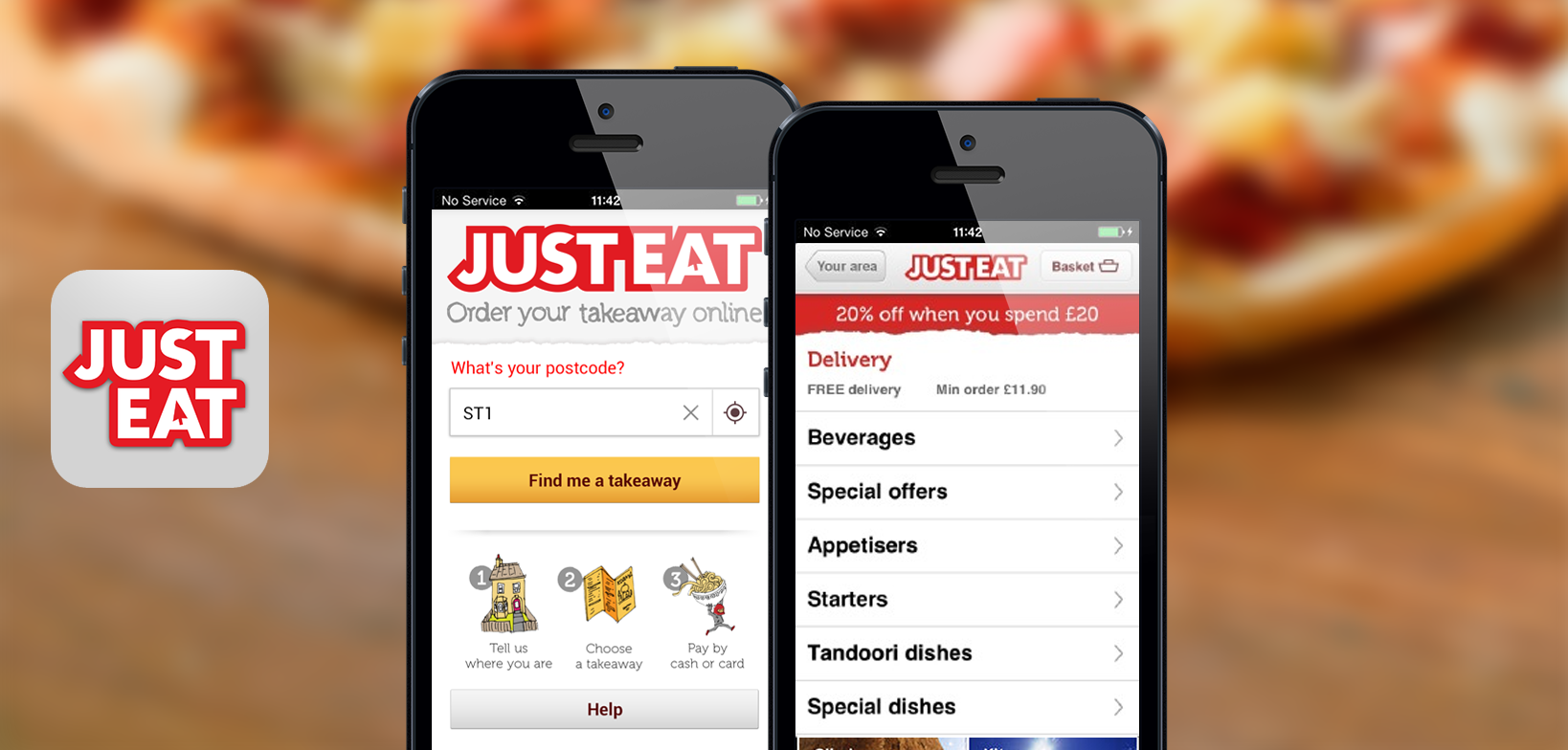

This is a good example of a potential App success story, because the company claims the majority of takeaway orders will be made using mobile phones within two years; it has put through more than 70 million orders since its launch and has more than 36,000 restaurants, in 13 countries, listed on its site.